Adding tax to retainer contract items

PERMISSIONS Manager

NAVIGATION Open a retainer contract > Options > Edit Contract or NEW > Contracts > Retainer > Step 2 of the wizard

The Retainer Tax feature allows your company to charge sales tax on eligible labor, charge, and expense items covered under a retainer contract. The tax is applied when items are approved and posted, and the amount is deducted from the retainer balance. The Retainer Tax feature is an installed module. There is no charge for this module.

- Specify which retainer contracts will have taxes applied to eligible contract labor and charges.

- In the Retainer Tax Contract Summary, view the total amount of tax deducted from the contract's retainer purchases.

- On the Labor Adjustment page, view the amount of tax deducted from a contract's retainer purchases by labor item.

- Track tax deducted from retainers in selected Autotask standard reports and several LiveReport families.

NOTE Taxes applied to labor, charges, and expenses and deducted from a contract retainer are not filtered from profitability calculations. Retainer Tax is counted as revenue, and therefore, profit. This arrangement affects the accuracy of revenue and profit calculations that include retainer contracts, and will be updated in a future release.

Getting started applying tax to retainer contract labor and charges

The following conditions are required to begin applying tax to a retainer contract's purchases. Some of these conditions may already be in place.

- The Retainer Contract module must be turned on.

To determine if the module is turned on, open the Contract Summary page for any retainer contract. If the module is enabled, the Contract Details list includes the Tax Deducted from Retainer field. If the module is not turned on, contact the Kaseya Helpdesk .

- The individual contract must have the option to charge taxes enabled. Refer to Applying the Retainer Tax to a Contract.

Applying the retainer tax to a contract

You must specify which contracts will include the retainer tax charge on eligible labor, charge, and expense items. You can do this when creating a contract or by editing an existing contract. When the Retainer Tax module is enabled, a check box is added to the following two pages:

- When creating a contract, the check box appears on page 2 of the New Contract Wizard. Refer to Charge tax on eligible labor and charge items.

- When editing an existing contract, the check box appears in the Dates & Billing section on the General tab. Refer to Creating a contract.

- A Tax Region must be associated with the contract organization. Together with the tax categories associated with the billing codes, it will determine the amount of tax subtracted from the retainer contract. Refer to Configuring your tax table.

- Items to be taxed must be billable and taxable. Refer to What Labor and Charges Will Be Taxed?

What labor and charges will be taxed?

When you specify that tax be charged on eligible labor and charges, the tax is only applied to labor, charge, and expense items that are associated with the contract, and are billable and taxable. The following labor and charges are included when they meet the specified conditions:

- Task labor, where the task time entry has an Work Type that is billable and taxable

- Ticket labor, where the ticket time entry has an Work Type that is billable and taxable

- Ticket Charges that are marked as "Billable to Organization" and have a taxable Material Code

- Project Charges that are marked as "Billable to Organization" and have a taxable Material Code

- Contract Charges that are marked as "Billable to Organization" and have a taxable Material Code

- Ticket and Task Expenses that are marked as "Billable to Organization" and have a taxable Expense Category.

- Project Expenses that are marked as "Billable to Organization" and have a taxable Expense Category.

NOTE Organization tax settings override all other settings. If the organization has a tax exempt setting, no tax will be charged regardless of the work type, expense category, or material code. You manage organization tax settings from the Organization page > Invoice Settings view.

For additional information on setting up work types, material codes, and expense categories as an Admin, refer to Introduction to billing for labor, Material codes, and Adding expense categories.

Viewing the total retainer tax amount deducted by contract

You can view the total amount deducted from a contract's retainer purchases in the Contract Details box on the Summary page.

Viewing retainer tax per item when adjusting labor charges

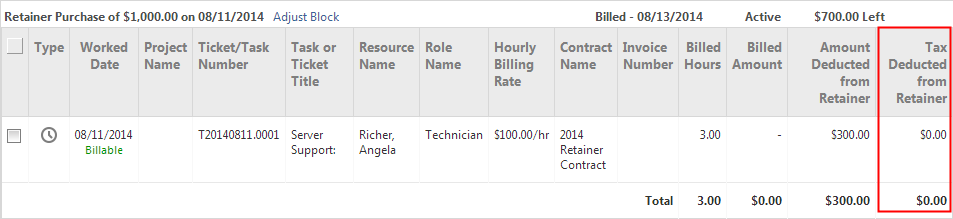

When you have the Retainer Tax module turned on, the Adjustments table on the Labor Adjustment page (Contracts > Invoices & Adjustments > Adjust Labor > Search for labor items to adjust) displays a column labeled Tax Deducted from Retainer. The tax deduction is reflected in the total that appears in $ [amount] Left.

Reporting on retainer tax deductions

You can track the amount of tax deducted from retainer purchases in several Autotask reports.

The Tax Deducted from Retainer field is available in the Retainer Contract Balance category. Refer to LiveReports.

The following standard reports display information about taxes deducted from retainer purchases.

-

Retainer deductions includes a column that indicates the Tax Deducted From Retainer for each item along with a total for all items.

-

Contract opening/ending balance does not break out the retainer tax amounts but the report includes the taxes deducted when calculating the Balance and Usage totals.

-

Pre-billing detail and Post-billing detail reports include the total Tax Deducted from Retainer along with the Totals, Overages, and Remaining amounts.

-

Profit & loss detail by contract report now displays a new line item for retainer contracts. Tax Deducted from Retainer appears with the per-contract totals. In addition, a new line item, Total Tax Deducted from Retainer, has been added to the report totals.

In Client Portal:

-

Retainers (Client Portal) report includes a column that indicates the Tax Deducted From Retainer for each item along with a total for all items.

NOTE Currently, taxes applied to labor, charge, and expense items and deducted from a contract retainer are not filtered from profitability calculations. Retainer Tax is counted as revenue, and therefore, profit. This arrangement affects the accuracy of revenue and profit calculations that include retainer contracts and will be updated in a future release.